When wealth is transferred—whether during life or after death—there are tax implications that can significantly impact both the giver and the receiver. Three terms that often come up in this context are gift tax, estate tax, and inheritance tax. Although they’re related, each one applies in different ways, at different times, and to different people.… Read More

Running a business comes with many responsibilities, and bookkeeping is one of the most critical tasks. Keeping accurate financial records ensures that your business remains compliant, financially healthy, and prepared for growth. But as a business owner, you may wonder, “Can I do the bookkeeping tasks my business requires?” The answer depends on various factors,… Read More

Living with debt can feel like carrying a heavy backpack uphill—stressful, exhausting, and sometimes never-ending. Whether it’s credit card debt, student loans, medical bills, or a car loan, paying it off can take strategy and persistence. The good news? There’s no one-size-fits-all solution, so you can choose a debt repayment method that fits your personality,… Read More

Raising children is one of life’s greatest joys, but it also comes with a hefty price tag. Between diapers, daycare, school supplies, and everyday living expenses, parents often find themselves stretched financially. Thankfully, the U.S. government provides a little relief through the Child Tax Credit (CTC)—a tax benefit designed to help families offset the cost… Read More

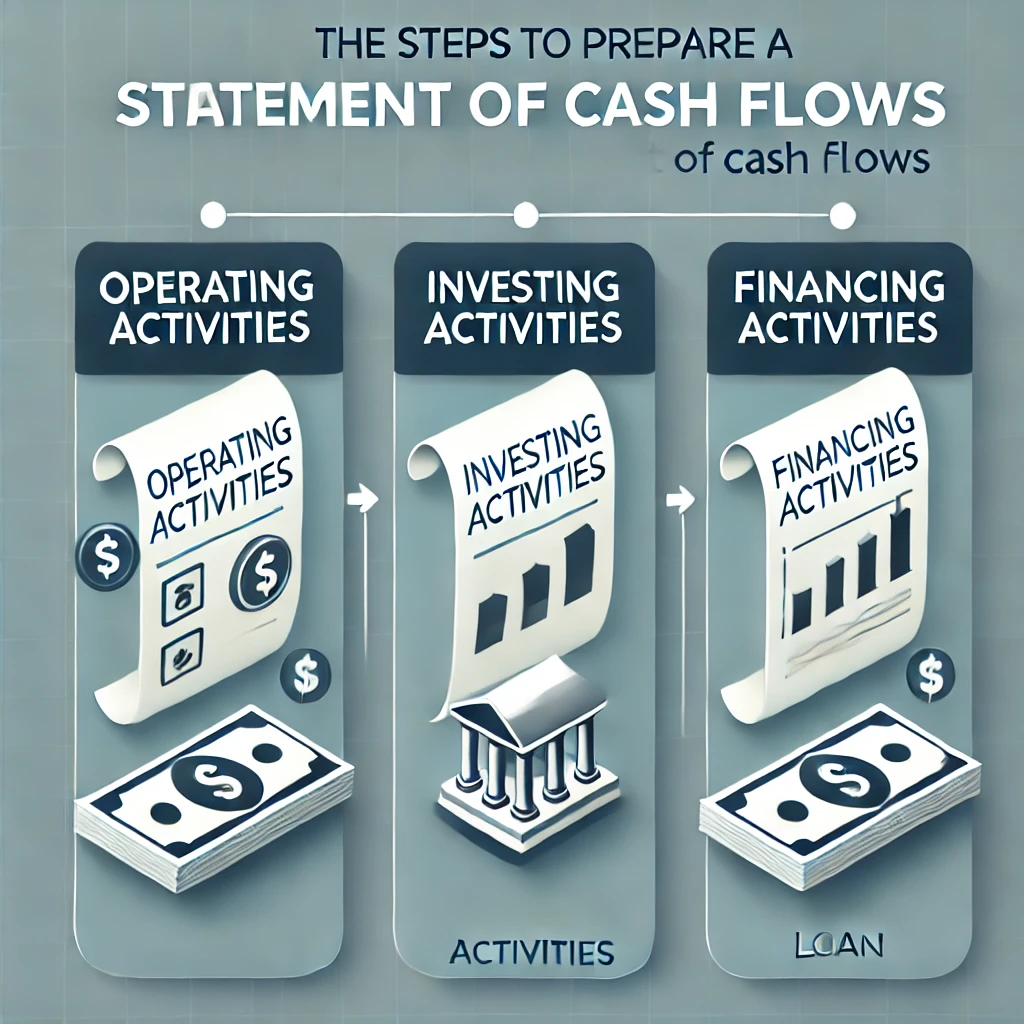

A statement of cash flows is one of the most important financial statements for a business. It provides valuable insights into a company’s liquidity, showing how cash moves in and out of the business over a specific period. Understanding how to prepare a statement of cash flows is essential for business owners, accountants, and financial… Read More

Your Social Security Number (SSN) is one of the most valuable pieces of personal information you have. It’s the key to your financial and personal identity, which makes it a prime target for identity thieves. If someone gains access to your SSN, they can open credit accounts, file fraudulent tax returns, or even commit crimes… Read More

If you work from home, whether as a freelancer, small business owner, or remote employee, you might be able to claim the home office deduction on your taxes. This deduction can help lower your taxable income and put some money back in your pocket. But, as with all things tax-related, there are rules to follow.… Read More

If you’re running a business, you know how crucial bookkeeping is. Keeping your financial records in order helps you make informed decisions, ensures compliance with tax regulations, and gives you a clear picture of your business’s health. However, managing bookkeeping in-house can be time-consuming, expensive, and, let’s face it—stressful. This is where outsourcing bookkeeping comes… Read More

We all love the idea of saving money, but let’s be honest—it’s not always easy. Between bills, daily expenses, and unexpected costs, it can feel like your paycheck disappears in the blink of an eye. But don’t worry! Saving money doesn’t have to mean giving up everything you love. With a few smart strategies, you… Read More

Investing in rental properties can be a lucrative venture, but many new property owners make mistakes that can have significant financial and tax consequences. Understanding these pitfalls and how they affect your bottom line is crucial for long-term success. Below, we’ll explore some of the most common mistakes and how to avoid them. 1. Failing… Read More